Opportunity Zone

The 2017 Tax Cuts and Jobs Act (TCJA) established Opportunity Zones to incite private investment in designated economically-challenged communities.

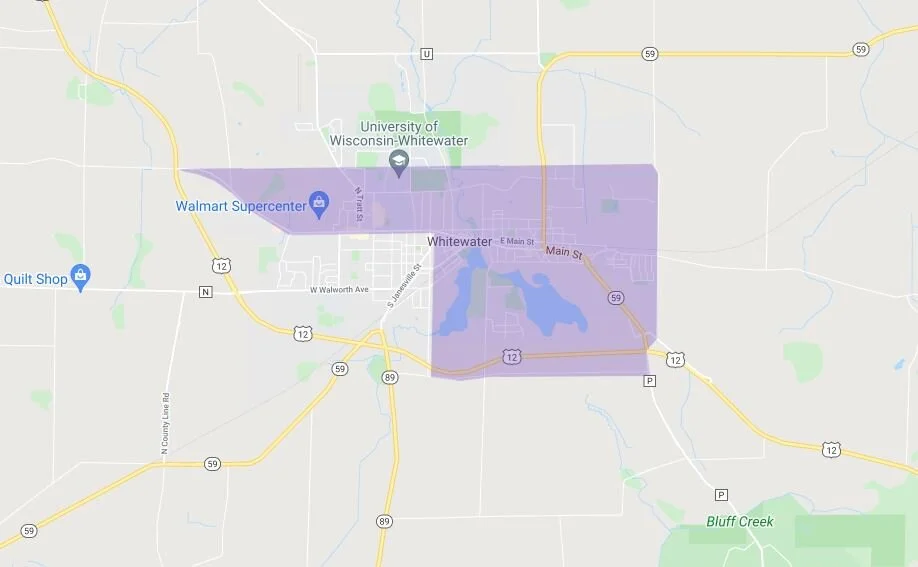

There are 120 designed Opportunity Zones throughout Wisconsin, covering more than 40 counties. Even though Whitewater straddles the Jefferson and Walworth county border, the Opportunity Zone is located entirely on the Walworth County side. The Whitewater Business Park and Whitewater University Technology Park lies within the Opportunity Zone.

Private investment in Opportunity Zones is encouraged through tax incentives.

Investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or until December 31, 2026. If the QOF investment is held for longer than 5 years, there is a 10% exclusion of the deferred gain. If held for more than 7 years, the 10% becomes 15% .

If the investor holds the investment in the Opportunity Fund for at least 10 years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged. (Source: IRS Opportunity Zones FAQ)

Please note drawing is approximate.